March CPI: Shelter Begins Its Descent

April 14, 2023

Executive Summary:

- Housing inflation began its descent; however, it masks continued strength in labor-sensitive prices.

- On its face, the data supports an additional rate increase at the Federal Open Market Committee’s (FOMC) May meeting, but we think bank earnings may derail that plan.

- Despite reassurances from policymakers that banking stress is subsiding, investors may draw an opposite conclusion once the economics of at-risk institutions are clear.

- Our preference remains high quality companies offering lower volatility and higher yields. The same goes for fixed income with our focus on investment grade spread products.

Housing Progress Amid Strength in Labor-Sensitive Sectors

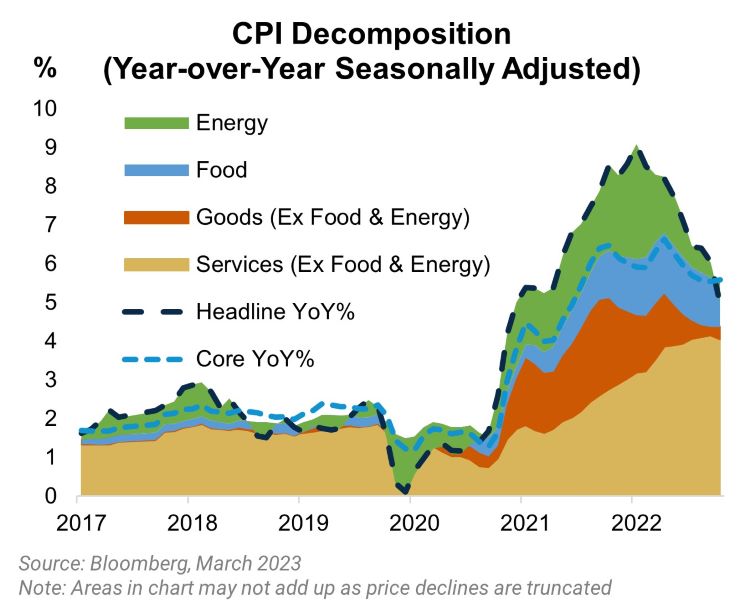

Headline inflation declined from 6% to 5.1% as the initial effects of Russia’s invasion of Ukraine rolled out of the index, meanwhile core ticked up 0.1% to 5.6% year-over-year. The anticipated decline in housing inflation began as the March Consumer Price Index (CPI) print showed rents and owner’s equivalent rent decelerated to 0.5 percent month-over-month. It was only a matter of time before shelter CPI would decline as private rent indicators slowed notably in the second half of 2022. Given the uncertain timing of the decline, the March data increases our confidence that inflation is likely to approach 2 percent towards the end of the year. Meanwhile, services excluding shelter and medical services, the Fed’s preferred measure lately, remains above target consistent with the underlying strength in the labor market. Other signs of strong discretionary demand remain as well with new vehicles, hotel prices, and airline fares all increasing month-over-month. The inflation data is consistent with continued tightening from the Fed, although the real hurdle will be what we learn from earnings season.

What Will The Banks Say?

Since the failures of SVB and Signature Bank, and the near collapse of Credit Suisse in March, the FOMC’s focus has shifted. What matters now is banks’ willingness to extend credit to the economy despite slowing growth and heightened sensitivity to banks’ liquidity and liquidation value. The other question is how will markets respond to banks’ decisions on the trade-off between profitability and liquidity. The message from FOMC and banking regulators so far suggests that both deposit outflows and shifts within the system have declined in recent weeks. Lending provided by the Federal Reserve through the discount window and the new Bank Term Financing Program corroborate the claim. The upcoming earnings season will go a long way in answering the two questions that matter.

One reminder for us and many other investors after the recent bank failures is that the system relies on trust. Banking at its core is about taking short-term, highly liquid liabilities and transforming them into longer-term, less liquid assets. There is no amount of regulation other than blanket deposit guarantees that can overcome a breach of trust for an institution. The salience of the recent bank runs changed the short-term incentives for banks. Executives will emphasize balance sheet liquidity, the stickiness of their funding base, and reduce unrealized losses on the balance sheet to reinforce depositors’ trust. For banks seeing deposit outflows this shift to a more liquid position will come at the cost of lower profitability as they take lower risks and the cost of their deposit franchise increases. We expect this pullback in lending to disproportionately impact small- and medium-sized businesses, which account for most employment, where smaller banks have a larger footprint.

While we feel confident that banks are going to reduce their lending at the margin, we are less confident in how markets are going to respond to banks’ guidance on this choice. It goes to another lesson we took from the recent bank failures is that bank balance sheets are extremely opaque, and in an information void, investors often choose to disengage rather than take a bet they do not fully understand. Earnings season will provide clarity on deposit beneficiaries and losers and which banks are the most reliant on official sector funding from the Federal Home Loan Bank System and the Fed’s lending programs. Once the economics of these shifts become clear for individual institutions it will not surprise us if markets respond negatively to earnings announcements. The system in aggregate may look fine today to policymakers, but the market could very well disagree.

Still Hard to Find Valuation Support For a Push Higher in Risk

In analyzing the various soft vs. hard landing scenarios, we find it difficult to justify significant upside from here outside of the most optimistic outcomes. If inflation continues to decline without a significant increase in unemployment, we see a gradual decline in interest rates limiting the upside for the equity multiple. Meanwhile, if we tip into a recession, earnings are more at risk. The tight range for equities in recent months feels appropriate to us until we see a definitive break in growth and inflation. Our view remains that a recession is likely and leaves us underweight risk overall. Although in this environment, we think our preference for quality exposures, lower volatility, and higher income makes sense even if you place a higher weight on a soft landing. For fixed income that continues to mean Agency Mortgage-Backed Securities and investment grade credit. For equities it means software, growth at a reasonable price, and defensive sectors like utilities that offer valuation support.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2847220