January CPI: Inflationary Pressures Slow to Come Off The Boil

February 15, 2023

Executive Summary:

- Consumer Price Index (CPI) for January increased in-line with expectations under the hood, however, there were some upside surprises.

- Importantly, core services ex housing, the “super core” metric Powell often refers to, were up +0.36% month over month (m/m) (+4.3% annualized rate) which suggests the Federal Reserve (Fed) has more work to do to bring down wage-sensitive services inflation.

- Bureau of Labor Statistics (BLS) recently revised their seasonal adjustment factor. The revision affects the monthly CPI prints for Q4 of 2022 and going forward. As a result, the average monthly pace of core CPI increase since October was upgraded from a +3.1% annualized rate to a +4.2% annualized rate. The revision is not trivial and suggests less slowing in inflation over Q4 than originally thought.

- All-in, this report was fairly in-line with expectations. Although, when coupled with recent seasonal adjustment factor changes and an overshoot of full employment, it does seem that inflationary pressures are coming off the boil slower than hoped. These recent developments point to the risk of a higher terminal rate and tighter financial conditions.

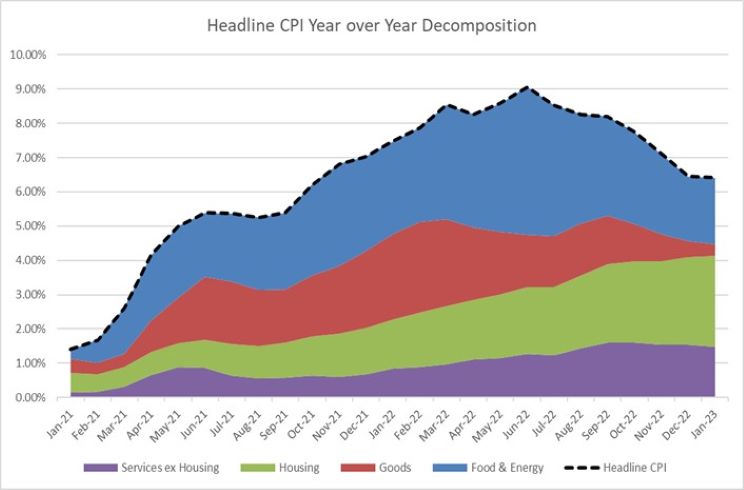

January CPI – Looking Under the Hood

CPI for January increased in-line with expectations, with headline up +0.5% m/m and core up +0.4% m/m, while headline rate ticked down to +6.4% year over year (y/y) and core moderated to +5.6% y/y. Under the hood, however, there were some upside surprises. Most notably, core goods increased +0.1% m/m which is the first positive monthly increase since September, and this occurred despite used car prices falling -1.9% m/m. Housing finally slowed incrementally in January but still remains very firm with a +0.7% m/m increase in both owners’ equivalent rents and tenant rents. Importantly, core services ex housing, the “super core” metric Powell often refers to, were up +0.36% m/m (+4.3% annualized rate). If we subtract airfares and health insurance, which are volatile and non-labor driven, core services in labor-intensive categories increased by +0.55% m/m which suggests the Fed has more work to do to bring down wage-sensitive services inflation. Lastly, despite expectations for strength in used cars given recent increases in the Manheim Used Vehicle Index, prices declined -1.9% m/m which suggests that price increases may not flow through until February’s CPI and points to more strength in core CPI ahead.

Recent Changes to CPI

BLS recently made revisions to their seasonal adjustment factor. The revision affects the monthly CPI prints for Q4 of 2022 and going forward. As a result, the average monthly pace of core CPI increase since October was upgraded from +0.26% (+3.12% annualized rate) to +0.35% (+4.2% annualized rate). The revision is not trivial and suggests less slowing in inflation over Q4 than originally thought. Additionally, BLS introduced new weights for the items within the CPI basket which takes effect beginning with the January 2023 print and not earlier. The largest changes were to reduce gasoline and used vehicles, while increasing owner’s equivalent rent. Since used car prices are expected to grow below average and rents are expected to grow above average, this has the net effect of adding strength to CPI forecasts for this year.

Policy Implications

Source: Bloomberg, February 2023

Over the last three months core CPI has increased at a +4.6% annualized rate, showing some acceleration from December’s three month annualized rate of +4.3%. Inflation is currently running too hot for the Fed to pause rate hikes, but the general trend of price growth is still lower which suggests we are getting close to the end of the hiking cycle. The Federal Open Market Committee (FOMC) will likely look through the tick up in core goods prices for the January print unless if it remains persistent which could prove problematic as lower goods prices are key to the disinflationary outlook. Rent of shelter continues to run very hot reflecting lagged moves in economy-wide rents from the surge in 2021-2022. New market rents since Q4 of 2022 point to eventual deceleration, however, later this year. This is another area the FOMC is most likely looking through given its lags, but if it remains more persistent than expected may become also become a problem. All-in, this report was fairly in-line with expectations despite some moderate upside surprises underneath the hood; although, when coupled with recent seasonal adjustment factor changes and an overshoot of full employment, it does seem that inflationary pressures are coming off the boil slower than hoped. These recent developments point to the risk of a higher terminal rate and tighter financial conditions.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2742170