It’s Time to Diversify Client Portfolios by Challenging Home Country Bias

February 06, 2023

Diversification should be a key area of focus in 2023 as advisors adjust client portfolios to capitalize on the significant changes in monetary and public policy.

Portfolios that have a home country bias may be negatively impacted as markets are expected to be more challenged and complex in the new economic regime than they have been in the past decade. Additionally, more surprises are to be expected in 2023 as outlooks are still clouded by recession fears and global economic uncertainty.

Because of the recent shift in market dynamics, advisors and fund managers will most likely need to work harder to generate investment returns going forward. This makes diversification an increasingly important component in portfolios, and presumably gives actively managed funds an advantage over passive funds in capturing returns.

Advisors seeking to adjust and/or rebalance their client portfolios should consider challenging home country bias as a powerful, impactful way to diversify their exposures. For portfolios that are overweight to the U.S., now may be an opportune time given relatively attractive valuations outside of the U.S.

The Harbor International Compounders ETF (OSEA) is a compelling solution for adding exposure to the foreign large-cap growth segment to portfolios. The fund is actively managed to offer quality exposure to international companies with expected sustainable earnings growth to help drive compounded long-term wealth creation.

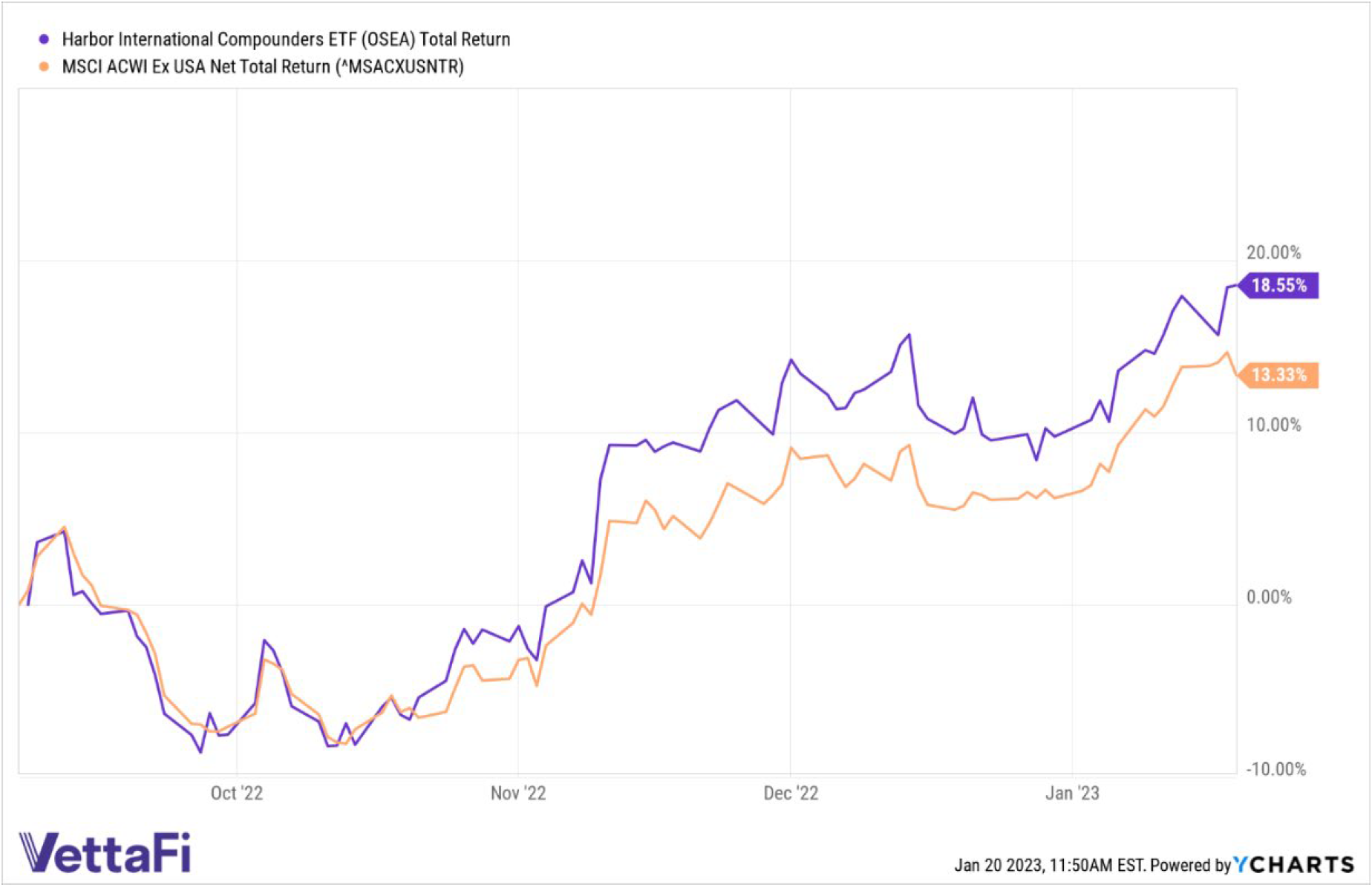

Quality active management has demonstrated strong outperformance as security selection continues to play a significant role in generating returns.

Since OSEA’s inception on September 7, the fund has returned 18.55%, while the benchmark index MSCI All Country World Ex. US Index has increased 13.33%, each on a total return basis, according to YCharts. The figures are looking at the total return level (using the closing price of the security that has been adjusted to include price appreciation, dividend, distribution, and expense ratio).

The fund’s distinctive high-conviction portfolio and benchmark agnostic approach can provide advisors with the greater versatility needed given the volatility in today’s markets versus more broadly diversified funds that either track the index or take more conservative bets.

OSEA subadvisor C WorldWide Asset management’s investment team seeks to identify high-quality companies with consistent recurring revenues, stable free cash flows, and sustainable returns on invested capital. As part of its security selection process, the investment team evaluates potential constituents by assessing each company’s business model, management, and financial and valuation metrics, among other things.

For more news, information, and analysis, visit the Market Insights Channel.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborcapital.com or call 800-422-1050. Read it carefully before investing.

All investments involve risk including the possible loss of principal. Please refer to the Fund’s prospectus for additional risks associated with the Fund. For the Fund’s prospectus and most current performance, please click OSEA.

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end at harborcapital.com or by calling 800-422-1050.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions. A non-diversified Fund may invest a greater percentage of its assets in securities of a single issuer, and/or invest in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio.

The MSCI All Country World Index (ND) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Home country bias refers to investors favoring companies from their own country over those from other countries or regions.

Free cash flow represents the cash a company can generate after accounting for capital expenditures needed to maintain or maximize its asset base.

Diversification does not assure a profit or protect against loss in a declining market.

C Worldwide is a third-party subadvisor to the Harbor International Compounders ETF

This article was prepared as Harbor Funds paid sponsorship with VettaFI. Originally published on VettaFi | ETFTrends.

Foreside Fund Services, LLC is the Distributor of the Harbor ETFs.

2840854