High August Inflation Resets The Fed Clock

September 14, 2022

Executive Summary:

- Unexpectedly elevated Consumer Price Index (CPI) data for August cements a large interest rate hike and further reduces the odds of a soft landing.

- Headline CPI was 0.2 percentage points above expectations as core CPI accelerated notably, beating consensus expectations by 0.3 percentage points.

- The Federal Reserve (Fed, FOMC) will be deeply concerned by the breadth of increases in core prices as it is further evidence of a wage-price spiral given the robust labor market.

- Before the August data, proxies of inflation expectations supported a benign, medium-term inflation outlook. However, these measures are of little comfort given the surprising August data.

- Expect higher for longer interest rates, volatility to remain elevated, and the difficult environment for equities and fixed income to continue.

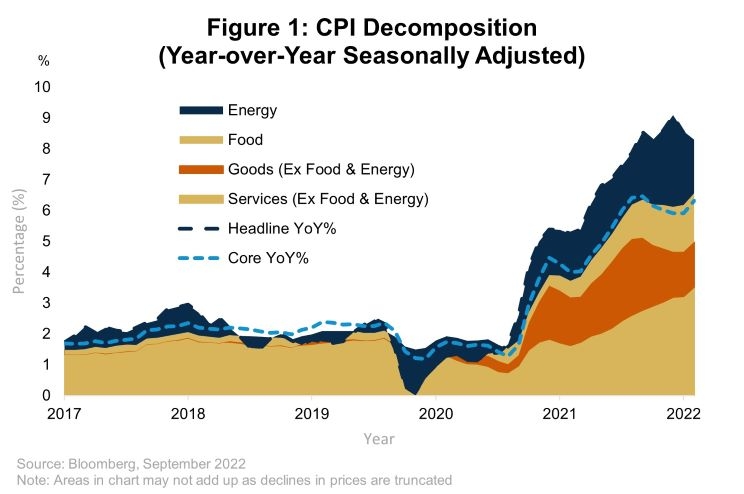

Focus Needs to Shift from Headline to Core Inflation

August CPI reinforces the idea that investors must shift their focus away from the idea of peak inflation and falling gas prices towards the pervasive strength of core inflation. While gasoline prices are very salient, and their recent decline goes some way in explaining the improvement in consumer sentiment, they do a poor job predicting future inflation as global factors account for a large share of their volatility as the war in Ukraine has demonstrated. Rather, it’s the sectors that comprise core inflation that are more persistent and reflective of cyclical factors, which underscore the difficult task ahead for the FOMC. Looking at the data, core goods reaccelerated to 0.5% month-over-month with durable goods prices like new vehicles and household furnishings increasing significantly, a sign that consumer demand remains healthy. The most concerning development was in shelter inflation, the largest component of CPI, which increased 0.7% month-over-month, the highest monthly increase since 1991.

The combination of high core inflation and elevated wage gains are concerning signals that the U.S. may already be in the midst of a wage-price spiral wherein higher wages produce ever higher prices. The core inflation data is clear, whereas the wage data is more muddled. The Atlanta Fed Wage Tracker, the Employment Cost Index, and Average Hourly Earnings point to high wage increases at 6.7%, 5.1%, and 5.2%, respectively, as of their latest readings. However, when adjusted for inflation, real wages for most workers have been negative since the pandemic. Looking across other labor market data, the risks are clearly to the upside for wages as the vacancy rate is at an unprecedented level, the unemployment rate is low, and monthly job increases are well above the demographic breakeven level.

Any thoughts of a Fed pivot after last month’s decline in prices should be cast aside and markets are responding accordingly. Market pricing for next week’s September FOMC meeting is indicating that another 75 basis point hike is the most likely outcome, albeit with a small possibility of a 100 basis point hike. Our baseline is a 75 basis point hike and a stern reminder from Chair Powell that the Committee will do what it takes to achieve 2 percent inflation at the September meeting. However, a late shift towards a 100 basis points hike is not out of the question based on the precedent set ahead of the June meeting where a press report immediately prior to the meeting signaled that a surprising 75 basis point hike was imminent. Regardless of the magnitude of next week’s rate hike, the CPI data resets the clock for the Fed and ensures that rate cuts in 2023 are unlikely absent a significant deterioration in the economy.

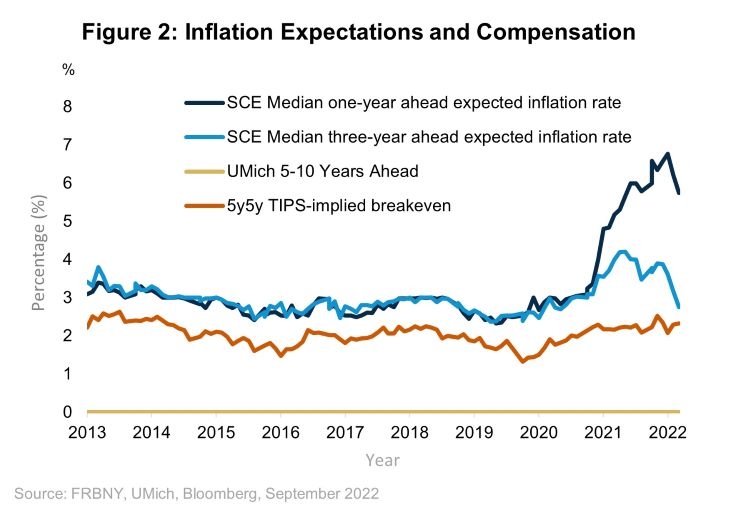

Medium-term Inflation Expectations Falling Despite Near-term Surprises

Our plan prior to the August data was to focus on measures of inflation expectations and their hopeful signal for inflation in 2023 and 2024. And while the August CPI print leaves us with little hope that the FOMC will be able to avoid a recession this cycle, inflation expectations suggest a return to low and stable inflation after the FOMC achieves its goal. Survey measures of forward inflation have declined significantly and are close to levels that prevailed prior to the pandemic. Market prices of inflation compensation, a proxy for inflation expectations given the existence of risk premia, like inflation swaps and TIPS-implied break-evens have also returned to pre-COVID levels. The normalization of inflation expectations signifies the credibility of the Fed’s commitment to reduce inflation. Unfortunately for markets, the August CPI data increases the cost of that commitment in terms of economic growth and equity market multiples.

If Costs are Rising, Equites are Declining

The August CPI data furthers our core conviction: a recession is highly likely by 2023 and earnings expectations are too optimistic. As a result, we maintain our underweight to equities and our overweight to more defensive sectors like healthcare and lower volatility factors. We do think there are pockets of value in higher beta sectors like communication services that have underperformed, but our overall beta remains low. In fixed income, our highest conviction bet remains our high yield underweight as we think higher funding costs combined with margin compression will challenge the viability of the most indebted firms. Elevated rate volatility has made it difficult to significantly add to overall duration leaving us near the benchmark with a material cash position given attractive risk/reward at the front-end.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2425956