Hedge Inflation and Diversify with Commodities

October 11, 2022

Executive Summary:

• Inflation has remained persistent. The year-over-year Consumer Price Index (CPI) recently reached a new 40-year high of 9.1% and has been greater than 5% for 15 straight months. While there are multiple ways to hedge inflation, we believe that commodities serve as the most effective asset class for investors seeking to guard their portfolios against inflation.

• Commodities have performed relatively well as of late with supply/demand dynamics driving prices higher. Alternatively, stocks and bonds have faltered due in part to anticipated rate hikes and inflationary pressures.

• Commodities have proven to be effective long-term portfolio diversifiers. Over the past 20 years, they have displayed low levels of correlation against domestic and international equities with a negative correlation to bonds.

An Effective Inflation Hedge

The June year-over-year (YoY) CPI reading came through at 9.1%, marking a new 40-year high and the 15th straight month of greater than 5% YoY increases in inflation. Investors have been looking for portfolio options to combat inflation and common choices have been TIPS, REITs and Commodity-Related Equities. However, we believe that an often-overlooked investment, commodities, may offer investors a better hedge in this period of elevated inflation.

.jpg)

Source: FactSet

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

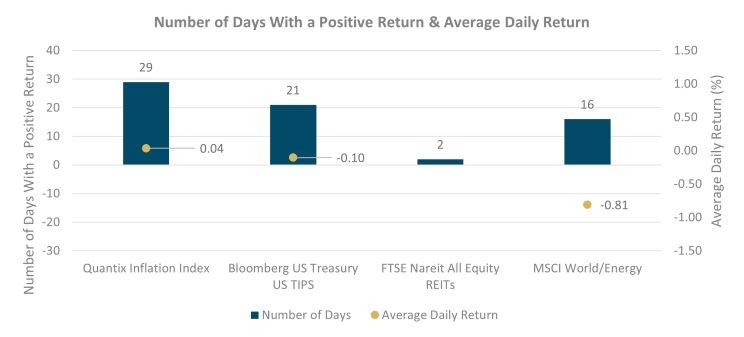

I: Inflation-Linked Bonds (Bloomberg US Treasury TIPS)

Pros: Nominal yield rises with measures of inflation.

Cons: Tips feature significant interest rate risk and have shown a weak relationship to inflation during periods of conventional monetary policy – e.g. when real interest rates rise.

II: Physical Assets (FTSE Nareit All Equity REITs)

Pros: Real estate has historically performed well in rising inflationary environments.

Cons: REITs have historically been rate-sensitive (bond proxies) and can be hurt by rising rates through

higher borrowing costs.

III: Commodity-Related Equities (MSCI World Energy)

Pros: Cash flows of commodity-related equities have historically risen with inflation, which may be able

Cons: Often narrow coverage related to a specific commodity and equity margins and earnings can be susceptible to rising input costs in inflationary environments.

Source: Morningstar. Indices represented are total return indices. Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

YTD Relative Performance and Correlations

One of the most important features of investing in Commodities is the difference between “spot” assets and “anticipatory” assets. Commodity strategies invest in spot prices of their underlying investments via futures contracts, meaning their performance is based on price movements happening today based on supply vs demand dynamics. This contrasts with stocks and bonds which are constantly pricing in future expectations.

As of September 30, 2022, there have been 50 days this year where the S&P 500 posted negative returns less than -1%; the index averaged a decline of -1.99% during those days. Commodities, as measured by the Quantix Inflation Index, have registered a positive return in 29 of those days and have averaged a +0.04% return (as seen in the chart on page 3). We believe this highlights the benefit of utilizing a commodity position in portfolios as a hedge for inflationary environments as well displaying potential short term correlation benefits.

- Commodity prices have been increasing this year reflecting the uneven supply vs demand dynamic unfolding today which has been further exacerbated by the geopolitical events in eastern Europe.

- Stocks and Bonds have experienced weakness as investors anticipate that elevated inflation could lead to a more hawkish Federal Reserve and consequently 1) higher interest rates and 2) a challenged consumer that is grappling with higher consumption costs.

Long Term Correlations

We believe commodities could serve as a strategic position in investor portfolios given their diversification potential. The chart below highlights the 20-year return correlations between Commodities and other common market indexes. Over the long term, Commodities have displayed low levels of correlation against domestic and international equities with a negative correlation to bonds.

Source: Morningstar

The Quantix Inflation Index (QII) launch Date is 14-Jan-21. All information for an index prior to its Launch Date is hypothetical backtested, not actual performance, based on the index methodology in effect on the Launch Date. The chart above shows the performance of the Index from 1/1/2022 through 5/31/2022 in comparison with equity and bond market proxies provided. The data for the QII TR Index is derived by using the Index's calculation methodology with historical prices for the futures contracts comprising the Index. Indices represented are total return indices. Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

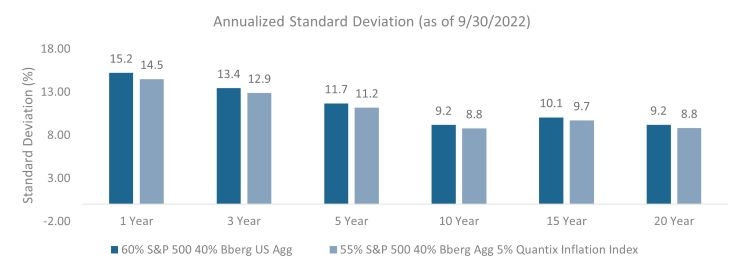

The charts below display the trailing standard deviation of a 60% S&P 500 & 40% Bloomberg US Agg Bond Index portfolio compared to a portfolio that shifts 5% of the equity allocation to the Quantix Inflation Index. Adding commodities had a volatility dampening impact over all trailing time periods, again highlighting the diversification potential of implementing an asset class that performs based on spot prices versus stocks and bonds that perform based on anticipated financial conditions.

Source: Morningstar

The Quantix Inflation Index (QII) launch Date is 14-Jan-21. All information for an index prior to its Launch Date is hypothetical backtested, not actual performance, based on the index methodology in effect on the Launch Date. The chart above shows the performance of the Index from 1/1/2022 through 5/31/2022 in comparison with equity and bond market proxies provided. The data for the QII TR Index is derived by using the Index's calculation methodology with historical prices for the futures contracts comprising the Index. Indices represented are total return indices. Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

Commodities as an asset class have come into much sharper focus for many investors, driven by an environment with inflation reaching more than 40-year highs, sharp interest rate increases, and major stock and bond markets faltering.

While a strong case can be made for investing in commodities today, the overall benefits that commodities can potentially deliver to a portfolio over the long-term may be just as, or even more important for investors to consider.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The performance data presented with respect to the Quantix Inflation Index Total Return (“QIITR”) (the “Index”) prior to 01/14/2022, represents pre-inception index performance data (“PIP data”) to illustrate how the Index may have performed had it been in existence prior to 01/14/2022.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals as of June 2022. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this article is for informational purposes only.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses Forecast and estimates are based on hypothetical assumptions and for informational purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The information presented does not represent the results that any particular investor may actually attain. Actual results will differ, and may differ substantially, from the hypothetical information provided.

This material may reference counties which may be generally the subject of selective sanctions programs administered. Readers of this commentary are solely responsible for ensuring that their investment activities in relation to any sanctioned country is carried out in compliance with applicable Laws, rules or policies.

The Quantix Inflation Index (QII) was developed by Quantix Commodities LP and is owned by Quantix Commodities Indices LLC (“Quantix”). The QII was created with the objective of being a diversified inflation hedge for investors using commodity futures contracts, traded in the U.S. and the U.K., as part of their core investment. Commodity futures are distinctive in their relationship to inflation and are generally regarded as having the highest positive correlation to inflation of all the major asset classes. The QII is designed to provide a risk management framework to hedge inflation risk appropriately in connection with commodity investing, taking account of the relative inflation sensitivity of each commodity among a defined universe of commodities, the relative cost of holding a rolling, U.S. or U.K.-listed futures position in a given commodity and the relative impact of inflation on each particular commodity.

The Quantix Inflation Index is calculated on a total return basis, which combines the returns of the futures contracts with the returns on cash collateral invested in 13-week U.S. Treasury Bills. The Quantix Inflation Index was developed by Quantix Commodities LP and is owned by Quantix Commodities Indices LLC.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The Russell 2000® Index is an unmanaged index generally representative of the U.S. market for small capitalization stocks. This unmanaged index does not reflect fees and expenses and is not available for direct investment. The Russell 2000® Index and Russell® are trademarks of Frank Russell Company.

The MSCI All Country World Ex. US Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The Bloomberg US Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Diversification does not assure a profit or eliminate the risk of loss.

Indices listed are unmanaged and do not reflect fees and expenses and are not available for direct investment.

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs may be registered with the SEC and are publicly traded on a stock exchange, or registered and not publicly traded. Treasury inflation-protected securities (TIPS) are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation in order to help hedge investors from a decline in the purchasing power of their money. Correlation is a statistic that measures the degree to which two variables move in relation to each other. Standard deviation measures the dispersion of a dataset relative to its mean.

Commodities and commodity-related products carry a high level of risk and are not appropriate for all investors. Commodities and commodity-related products may be extremely volatile, illiquid and can be significantly affected by underlying commodity prices, world events, import controls, worldwide competition, government regulations, and economic conditions. Fixed income investments are affected by interest rate changes and the creditworthiness of the issues held. As interest rates rise, the values of fixed income securities held are likely to decrease and reduce the value of a portfolio. High-yield investing poses additional credit risk related to lower-rated bonds. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions

2319075