Harbor Overseas Fund’s Alpha Edge

July 13, 2022

Key Takeaways

- We believe Acadian has an distinct approach to using quantitative methods that seek to generate equity insights utilizing fundamental metrics.

- We believe Acadian’s robust human capital combined with a culture of continuous self-reflection and improvement has the potential to set them up for continued innovation and improvement in this area.

- Given the breadth of approximately 34,000 securities in non-U.S. markets, we believe a quantitative approach that continuously monitors this massive universe is a compelling option for investors.

- We believe Acadian’s ability to adapt to market conditions means the Harbor Overseas Fund has the potential to serve as an all-weather portfolio.

At Harbor, we are not beholden to one approach to investing and believe there are multiple ways that talented managers have the potential to outperform their benchmark over a market cycle. We partner with managers that employ both fundamental and quantitative approaches. More important to us is the discipline and repeatability of each manager’s process. Additionally, we look for a culture of continuous self-reflection and improvement.

Acadian is a manager that we believe has an distinct approach to quantitative investing, employing a sophisticated multi-factor approach with a culture of continuous refinement which we feel is imperative in quantitative investing for multiple reasons. The industry is rapidly expanding in terms of data availability, evolving in terms of statistical techniques, and innovating in areas like machine learning and artificial intelligence. Continuous innovation is key for quantitative investors to help preserve alpha generation because signals can grow stale as more and investors become wise to them.

Continuous Evaluation of a Growing Opportunity Set

Acadian is the subadvisor for the Harbor Overseas Fund, a diversified non-U.S. equity strategy. We believe quantitative methods are particularly relevant in a strategy like this given the breadth of the investable universe, and investing in U.S. equity markets may seem relatively simple compared to broad non-U.S. mandates. In the U.S., managers may cover one of the nine style boxes and mainly focused on the macroeconomic and policy conditions of one country.

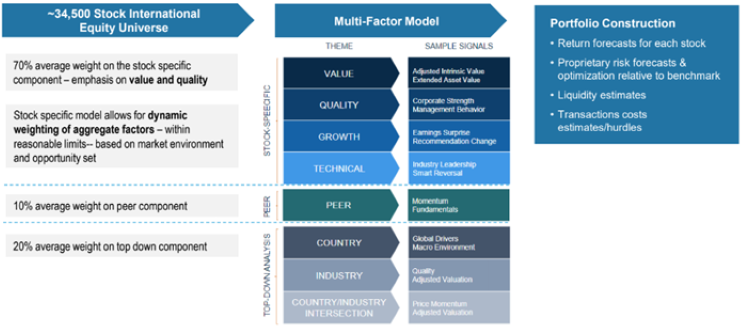

Conversely, Acadian is employing a strategy that invests in both growth and value companies up and down the market cap spectrum across the entire globe. Within the Fund’s benchmark, the MSCI EAFE Index, there are 21 countries, all of which with their own social, economic, and political nuances. However, given the Fund invests about 7% of assets in Emerging Markets, it may be more appropriate to evaluate the breadth of the MSCI ACWI ex USA Index which contains 47 countries. There are over 34,000 stocks within their international equity universe.

Acadian’s model can continuously monitor this growing universe of companies, providing 18-month return estimates for every security multiple times per day. The model incorporates both top-down and bottom-up elements to their security forecasts. For example, the model may have a negative top-down view on Germany but a positive bottom-up view on the Automobile industry and will incorporate both of those views into its return outlook for a company like Volkswagen. Furthermore, the model will also dynamically weight its stock specific factors (value, quality, growth and technical) based on the market environment.

Acadian Model Overview

While Acadian can rapidly adjust return forecasts based on evolving market and company conditions, they also carefully account for transaction costs when adjusting the portfolio. As such, portfolio turnover remains modest given this flexibility, averaging 87% over the last 3 years.

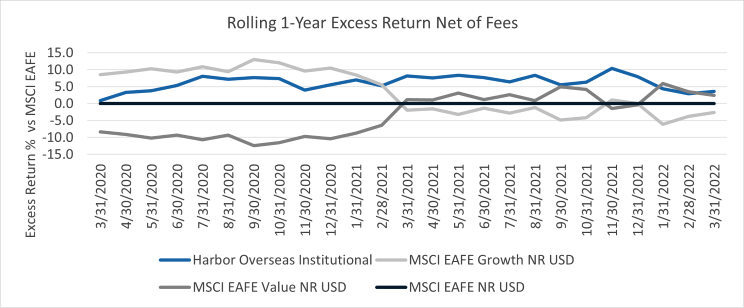

Process Aimed to Generate a Consistent Return Profile

Acadian takes a distinct approach to each of their factors and forecasts are generated utilizing over 100 individual inputs underlying these factors. Given this robust analysis combined with their dynamic factor weighting, we believe Acadian’s ability to continuously monitor and adjust their portfolio based on the current market conditions may allow the Harbor Overseas Fund to serve as an "all weather" portfolio. The Fund has demonstrated this disposition over the past few years. In 2020, markets favored more growthoriented companies amidst the COVID lockdown environment before value rotated into favor in 2021 amidst the vaccine deployment and economic reopening. The Fund has performed favorably in both environments.

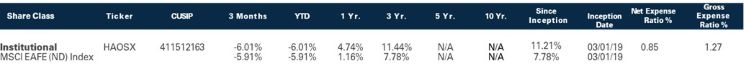

Source: Morningstar, March 2022

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end on our website or by calling 800-422-1050.

The above chart shows how the MSCI EAFE Growth and Value have performed since Fund inception. You can see there have been periods of both Growth and Value outperformance and the Fund has consistently outperformed the MSCI EAFE Index across these different environments.

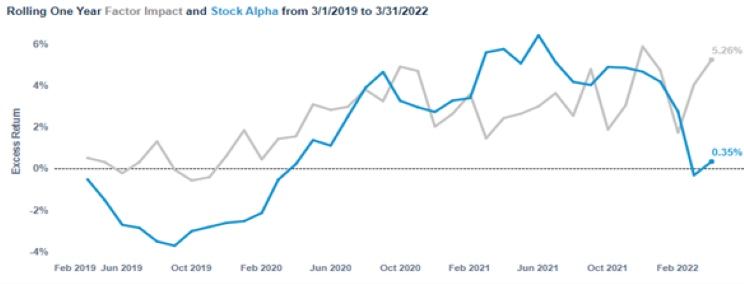

In fact, since the Fund’s inception in March of 2019, it has experienced a positive rolling 1-year factor impact 89% of the time. We believe this illustrates the benefits of Acadian's multi-factor approach.

Acadian Multi-Factor Portfolio Approach For Harbor Overseas Fund Gross of Fees

Source: FactSet, March 2022

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end on our website or by calling 800-422-1050.

Culture of Continuous Improvement: Evolution of the Value Factor

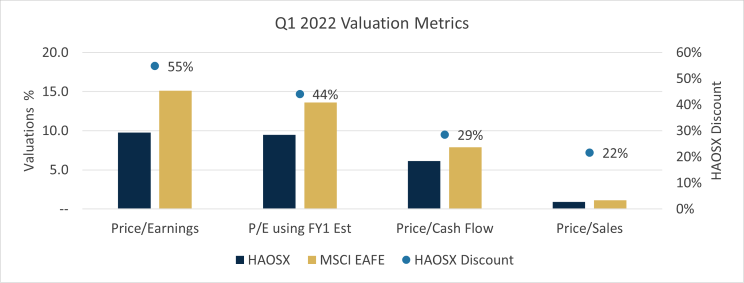

One of the key enhancements to the Acadian model over the years has been their work on the value factor. It is not uncommon to see this portfolio trade at a sizable discount relative to the MSCI EAFE index. Looking at data as of 3/31/2022, the portfolio is currently trading at a more than 40% discount based on trailing and forward P/E measures.

Source: FactSet, March 2022

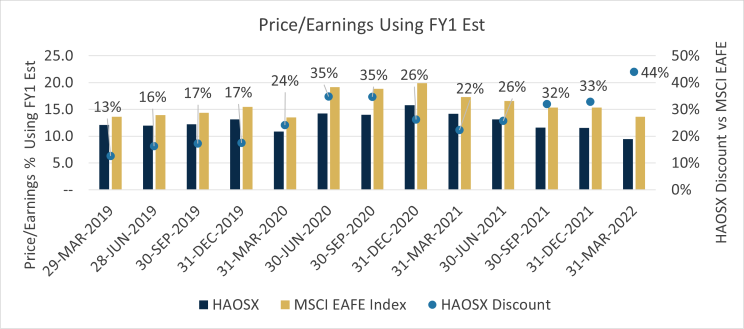

And if you look at these metrics over time, these types of discounts are common. This table shows the quarterly forward Price/Earnings ratio (P/E) since Fund inception and illustrates that the portfolio has consistently traded at a discount relative to the index.

Source: FactSet, March 2022

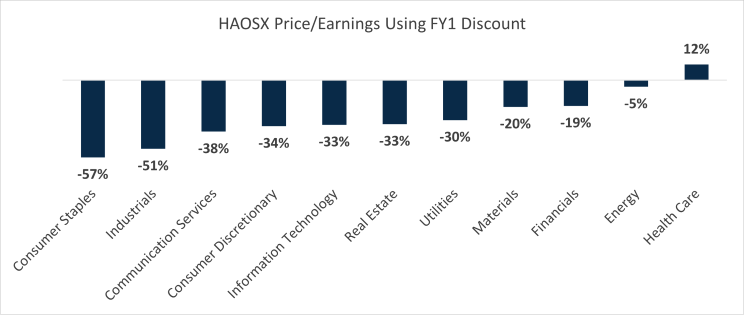

When investors see this type of valuation discount, they may expect the manager to have large positions in many of the cheaper areas of the market like Financials and Energy. This is not the case for Acadian. How? Their “value” focus is on attractive relative valuation within each industry peer group.

Furthermore, Acadian does not just use commonly defined industry peer group definitions. Instead, companies are grouped based on similar characteristics and exposures using a sophisticated statistical technique called “clustering”. “Value” is defined at what looks cheap relative to peers within each cluster, meaning the fund has the potential to find relative value across a variety of sectors and industries. In fact, as of 3/31/2022, the Fund was trading at a relative valuation discount across 11 of the 12 MSCI Global Industry Classification Standard (GICS) sectors.

Source: FactSet, March 2022

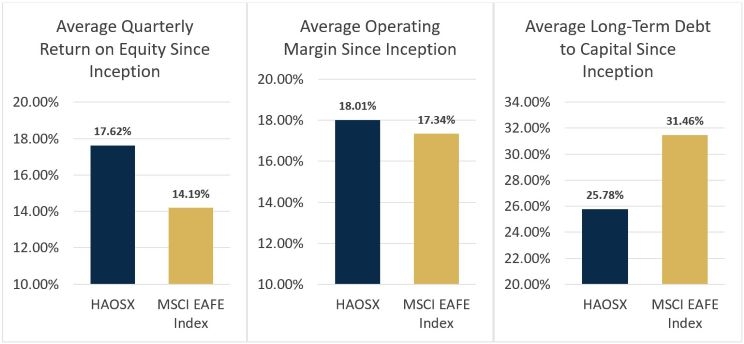

However, valuation is just one input to Acadian’s security analysis. Equally as important are how companies score on various fundamental measures within the “growth” and “quality” factors. Despite the sizable valuation discount, this portfolio has averaged a 24% premium relative to the MSCI EAFE Index in terms of Return on Equity, a 3% premium on Operating Margin, and a 18% discount on Long-Term Debt to Capital since the Fund’s inception. We believe this is a portfolio of inexpensive companies that are financially healthy.

Source: FactSet, March 2022

Performance data shown represents past performance and is no guarantee of future results. Past performance is net of management fees and expenses and reflects reinvested dividends and distributions. Past performance reflects the beneficial effect of any expense waivers or reimbursements, without which returns would have been lower. Investment returns and principal value will fluctuate and when redeemed may be worth more or less than their original cost. Returns for periods less than one year are not annualized. Current performance may be higher or lower and is available through the most recent month end on our website or by calling 800-422-1050.

Important Information

For Institutional Use Only. Not for Distribution to the Public.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit our website or call 800-422-1050. Read it carefully before investing.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political, and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions.

The value of securities selected using quantitative analysis can react differently to issuer, political, market, and economic developments than the market as a whole or securities selected using only fundamental analysis. The factors used in quantitative analysis and the weight placed on those factors may not be predictive of a security's value. In addition, any model may contain flaws, or the model may not perform as anticipated.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

The MSCI All Country World Ex. US (ND) Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global developed and emerging markets, excluding the U.S. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The MSCI EAFE (ND) Index is an unmanaged index generally representative of major overseas stock markets. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Diversification in an individual portfolio does not assure a profit.

Acadian Asset Management, LLC is a third-party subadvisor to the Harbor Overseas Fund.

Distributed by Harbor Funds Distributors, Inc.