FOMC Delivers a Hike, Promises More

March 22, 2022

Executive Summary

- The March Federal Open Market Committee (FOMC) delivered an interest rate hike almost 2 years to the day since their emergency response to COVID-19 cut rates to zero. Chair Powell and the Committee also laid out their intention to rapidly remove accommodation with inflation running well ahead of their 2 percent target and the economy at full employment.

- Based on their Summary of Economic Projections (SEP) and statement language, the Committee clearly sees the war in Ukraine as threatening their ability to reduce inflation. With the rate increase well telegraphed, markets were focused on the Committee’s intentions for the path forward.

- Initially, financial conditions tightened following the meeting with rates and spreads higher, equities falling, and the dollar strengthening; however, much of the price action reversed into the close.

- We think the initial response to the meeting is the right one. The Committee intends to tighten financial conditions and is willing to suffer the associated costs.

Hike Today, Long Trail Ahead

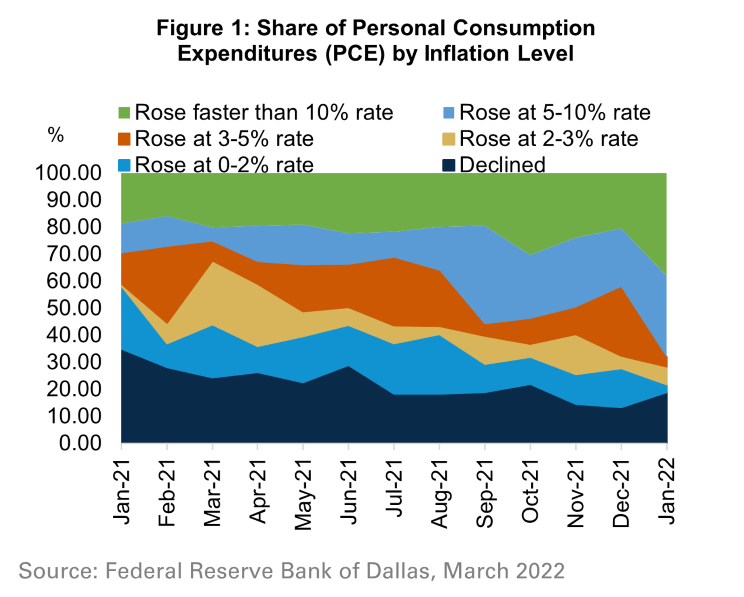

Getting into the details of the March FOMC events, the Committee increased the target range for the federal funds rate by 25 basis points. The FOMC also released an updated SEP, with the last forecasts coming in December, which had extensive revisions to growth, inflation, and the rate path. 2022 growth was revised down by 1.2 percentage points to 2.8 percent, meanwhile 2022 inflation was revised 1.7 percentage points higher to 4.3 percent. In explaining the revisions to near-term growth and inflation, Powell noted that the effects of the war certainly played a role, but he stressed that data since the start of the year indicated a broadening of inflation pressures and waning growth.

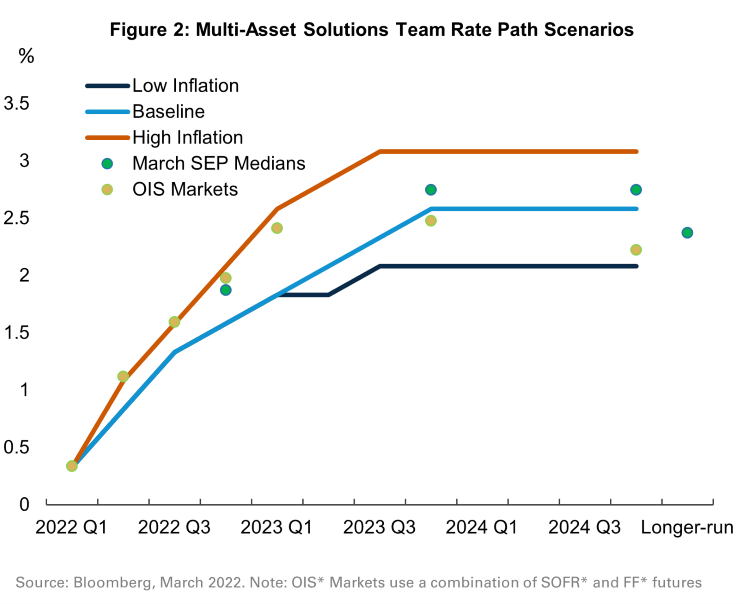

The revisions to the growth outlook also entail the anticipated effects of additional Federal Reserve (Fed) tightening, which the SEP laid out clearly. The median projection for the number of rate hikes increased from 3 to 7 hikes in 2022. The combination of a more front-loaded rate path with additional hikes in 2023 led the median dot for 2023 and 2024 to exceed the Committee’s long-run estimate of neutral of 2.5 percent. The dot plot and Chair Powell’s press conference were intended to send a very clear message: the Committee is concerned that inflation expectations will become unanchored, so restrictive policy will likely be necessary to dampen inflation. Chair Powell took a few questions explicitly asking whether the Committee needs to tighten financial conditions more and whether real yields need to rise further. He was quite clear that many on the Committee see real rates entering restrictive territory which implies real yields north of 0 percent, well above the -0.6 percent where 10-year real yields are currently. Restrictive policy and higher real rates increase the likelihood that the Fed will be unable to achieve a soft landing and could tip the economy into a recession in ’23 or ’24.

The data and information noted is based on hypothetical assumptions. It is for informational and illustrative purposes only. This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The hypothetical estimates presented do not represent the results that any particular investor may actually attain. Actual performance results will differ, and may differ substantially, from the hypothetical estimated performance.

*OIS – Overnight Indexed Swap

*SOFR – Secured Overnight Financing Rate

*FF – Fed Funds

Another open question in the SEP pertains to their inflation forecasts. The median projection for 2024 core Personal Consumption Expenditures (PCE) is 2.3 percent when many FOMC participants expect policy to be in restrictive territory. While the medians that fall out of the economic projections can sometimes lead us astray, an open question is what the Committee’s tolerance band for inflation is in the medium-term before they choose to act. In other words, is 2.3 percent sufficiently high for the Committee to move policy into restrictive territory? My guess is no, they would not risk higher unemployment and slowing growth to lower inflation from 2.3 to 2 percent, but the lower their tolerance is the greater the possibility that fine-tuning policy leads to a mistake.

The Committee left balance sheet policy alone this meeting, although Chair Powell made it clear that the drawdown of the balance sheet will commence at a “coming meeting.” The language is deliberately vague but based on Powell’s comment that balance sheet runoff “will be faster and will look familiar” and “that the minutes will contain more details”, we think they will announce the plan in May and start in June. The Committee remains cautious around using the balance sheet as an active tool and earlier risks of more aggressive action on the housing market specifically appear lower today.

Higher Hurdles for Risk Returns

The positive response in markets surprised us and we do not expect it to last. We agree with the Fed that financial conditions need to tighten further and are confident in its ability to deliver. As a result, we continue to position for a growth and earnings slowdown by favoring quality growth and defensive equity exposures. Yields have risen significantly since the start of the war in Ukraine, and we think there is still further room to go as real yields increase. However, the risk/reward of reducing our underweight to fixed income is becoming more attractive.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Legal Notices & Disclosures

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Harbor Capital Advisors, Inc.