Energy Transition Q&A

November 18, 2022

Executive Summary

- The world is undergoing a dramatic energy transition that has been accelerated by recent events such as the COVID crisis, the Ukraine war, and growing concerns about climate change.

- What is energy transition? Energy transition refers to the global societal shift from fossil-fuel-based sources of energy (e.g., oil, natural gas, and coal) to cleaner and renewable energy sources such as wind, solar, biofuels, hydropower, and nuclear energy.

- While this transformation has been in process for several years, its recent acceleration has exposed the global dependency that fossil fuels have on our society and the need for alternatives. When a generational change of this magnitude is in motion, investors look for expert answers to better understand the broader implications these changes could have on the world around them, and their investment portfolios.

Spencer Logan: There's a lot of noise around the importance of the transition to renewables. Reasons ranging from decarbonization due to global warming, to achieving energy independence due to national security have been provided as rationale for change. Cutting through all of the tumult, what is the purpose of the energy transition, and what is the biggest misunderstanding?

Morten Springborg: There is broad consensus that Earth is heating up. According to NASA, in 2020 the planet’s average temperature was 1.02°C warmer than the baseline 1950–1980 mean. Global warming, in addition to causing the polar ice caps to melt and sea levels to rise, is causing other climate changes like desertification and an increase in extreme weather events such as hurricanes, floods and fires.

The scientific community agrees that this is due to anthropogenic emissions of greenhouse gases into the atmosphere, especially since the Industrial Revolution. The main such gas, carbon dioxide, originates largely from the burning of fossil fuels like coal, natural gas, and oil.

In December 2015, at COP 21 in Paris, an international agreement was signed that set the target of limiting global warming by the end of this century to below 2°C compared with pre-industrial levels and preferably limiting it to 1.5°C.

To achieve this goal, our main tool is the energy transition, i.e., the shift from an energy mix based on fossil fuels to one that produces very limited, if not zero, carbon emissions. A huge contribution to decarbonization comes from the electrification of consumption, replacing fossil fuel-generated electricity with energy generated from renewable sources, which also makes other sectors like transport cleaner.

Historically speaking, energy transitions are not new. In the past, we have seen huge epoch-marking shifts like the transition from using wood to using coal in the 19th century or from coal to oil in the 20th century. But what distinguishes this transition from its predecessors is the fact that this time the transition involves going back to energy types that have lower energy density than the energy we want to replace. And this is the biggest misunderstanding.

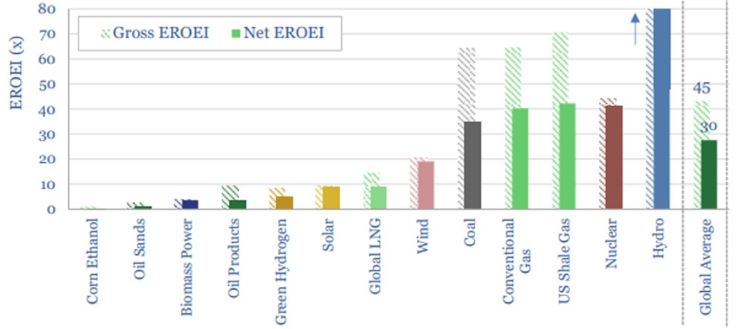

The economic prosperity created over the last two centuries results from the utilization of high-quality energies that have, over time, increased the energy return per unit of energy invested (EROEI), see graph below.

Source: Thunder Said Energy, October 2022

For every unit of energy invested in the production of coal or natural gas, the resultant output or return is 40-fold larger and approximately similar to the return on nuclear energy. This surplus energy has been available for the broader economy to utilize to such an extent that an American person, on average today, consumes an amount of energy equivalent to 110 times the energy the body needs to survive every day. In pre-industrial times this amount of energy consumed was close to 1 times the body’s consumption.

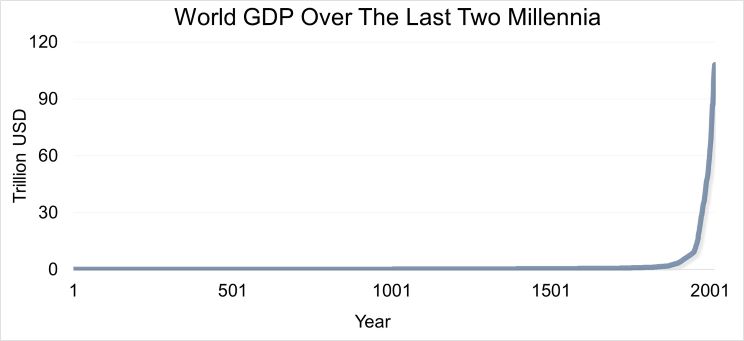

The availability of modern dense energy from the time of the industrial revolution 200 years ago has been the driving factor behind the historical rise of economic output and prosperity. Before the utilization of modern fuels, economic growth was barely visible, as shown in the chart below.

Source: Our World in Data based on World Bank & Maddison, 2017

Over the last 20 years, the total investments into wind and solar have globally been around $4.600 bn USD. This has reduced fossil fuels’ share of global primary energy from 87% to around 84%. It is unlikely that pursuing the same strategy we have done over the last 20 years for the next 100 years will lead to a successful energy transition as defined today.

Spencer Logan: The Russia-Ukraine conflict has altered the global landscape for energy production and consumption. What did the short- and long-term outlook for global energy markets look like before the conflict versus what it looks like today?

Morten Springborg: In 2021, energy prices, especially natural gas and electricity in Europe, were starting to rise, indicating a tight market.

We had been flagging that the world had underinvested in primary energy since at least 2015, a consequence of the desire to decarbonize the world economy. In 2015 total investments in primary energy were approximately $1000 bn, which had fallen to $ 870 bn by 2021. In a world with growing energy demand, the lower investments were bound to create scarcity; however, an even bigger factor behind the energy scarcity was the changed investment mix; Renewable investments rose from $ 250 bn in 2015 to 340 bn in 2021 while fossil (coal, natural gas, and oil) fell from 750 bn to 530 bn. Superficially, one could argue that this is what is needed to combat climate change, reducing carbon emissions. However, a deeper analysis reveals the true complexities of the energy transition, namely that the concept of energy density is hugely important; fossil energy is many times denser than renewable energy, and one unit of capital invested in fossil energy produces up to 25 times the amount of energy produced from a renewable energy source like solar PV or wind. The rising renewable investments have not been sufficiently large to compensate for the reduced fossil investments, so when we entered 2022, the spare capacity in global energy markets was historically low.

The war was a shock for especially the European energy markets. Up to 40% of natural gas consumption was sourced from Russia. Europe has been successful in subsidizing Russian gas with imported liquified natural gas, primarily from the U.S., but at extremely high prices. Since natural gas is the marginal fuel for electricity production in Europe, that has led also to extremely high electricity prices.

We believe the supply situation looks better today for the coming winter than expected only a few months ago but will depend on how the winter develops. Next year looks more challenging for European supply since we must assume Russian gas volumes – in contrast to this year - will be missing all year and that China will be reopening after Covid lockdowns, therefore returning to the global Liquified Natural Gas (LNG) market and competing for volumes with Europa.

We believe the medium-term outlook for energy is one of structural deficits for most of the 2020s. Efficiency improvement, demand destruction, coal, and expensive imported liquified natural gas, as well as accelerating investments in renewables, will balance the market.

Spencer Logan: The International Energy Agency details more than 400 sectoral and technology milestones necessary to achieve net zero by 2050. In your view, what is needed for the energy transition to be successfully executed? Will fossil fuels such as natural gas and others play a role, or is clean technology development the only answer?

Morten Springborg: We believe that the world must accept that we can’t get off fossil energy within any reasonable timeframe. Energy transitions take time! Coal is dirty and needs to be removed from the energy system asap. To do this, a massive ramp-up in natural gas will be required since natural gas emits 50-60% less CO2 per unit of energy output. On top of big investments in renewables, nuclear, and nature-based carbon sinks (NBCS). We will continue to use fossil fuels long after 2050. Therefore, we need to address the carbon emissions entering the atmosphere. This will be done industrially with carbon capture technologies, but much more effective and cheaper, building out NBCS’s.

Spencer Logan: What are the most significant obstacles to the energy transition?

Morten Springborg: Very little understanding of the concept of energy density. We need to accept fossil energy in the mix, combined with NBCS’s. Invest massively in the whole natural gas supply chain as well as reforestation, biochar, and other sequestration opportunities.

The energy transition cannot be without a massive buildout of nuclear energy, which is extremely dense, baseload power, and CO2 free.

Accept the market is a better capital allocator than politicians and introduce broad-based CO2 taxes, which will lead to the lowest cost decarbonization trajectory for the world economy.

Spencer Logan: Where do you see the biggest investment opportunities?

Morten Springborg: Accelerating Renewable energy capacities will be a preferred avenue to address the energy transition. We believe yearly RE capital investments will at least triple by 2040. We think well-placed owners and operators of renewable power will have very interesting investment opportunities in the years to come.

We believe that nuclear energy will see a big acceleration in the decades to come and is an interesting area to follow, although the investment story might still be immature. Energy efficiency technologies should see massive growth opportunities, such as insulation and electric motors. Industrial gas companies appear well hedged in the energy transition as providers of gasses that go into fossil processes as well as LNG and hydrogen.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

The views expressed herein are those of Harbor Capital Advisors, Inc. and C WorldWide Asset Management investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice or a recommendation to buy or sell any particular security or to adopt any investment strategy.

2601864