Duration Neutral Doesn’t Necessarily Mean Sector Neutral for Core Fixed Income Strategies

March 24, 2022

Executive Summary

- The combination of Federal Reserve policy shifts, low yields and inflation have many investors increasingly questioning the role of Treasuries within fixed income allocations, particularly as Treasury bond performance has faltered.

- Ideally, Treasuries serve as a ballast in client portfolios while also offering positive real return potential. Going forward, these expectations have become more clouded given the current low yield / high inflation environment and their inconsistent historical correlation to equities.

- This challenge is further amplified in that Treasuries make up a significant component of commonly utilized core bond indexes as well as funds within the Morningstar Intermediate Core Bond Category.

- We believe that many funds that are meaningfully underweight duration (as a byproduct of wanting to be underweight Treasuries) face the risk of being on the wrong side of interest rate moves (making an implicit interest rate bet) and are likely sacrificing precious yield in a still low‐rate environment.

- As a solution for investors, the Harbor Core Bond Fund currently offers a similar yield and duration profile to the benchmark with a significantly lower weight to Government securities.

Problems Ahead for US Treasuries?

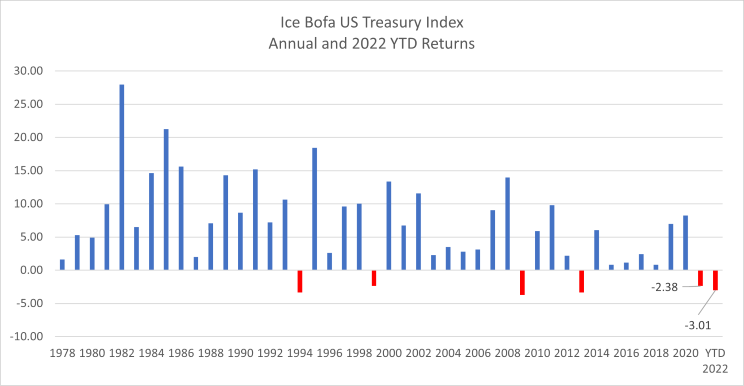

Near historically low yields, inflation, and the recent shift in Federal Reserve policy have caused many investors to increasingly question the role of Treasuries within their client’s fixed income portfolio allocations. These concerns are justified by the recent poor performance of Treasuries overall, where 2021’s negative return for the ICE BofA U.S. Treasury index represented just the third negative return for the index over the last two decades (Exhibit 1). In addition, with interest rates currently rising from historic and pandemic lows, YTD performance for Treasuries (‐3.66% through 2/10/22) suggests that we might be on pace for the first back‐to‐ back years of negative returns for Treasuries in this author’s lifetime. (DOB 1978)

Exhibit 1

Source: Morningstar Direct. As of February 2022.

Even more worrisome is how strong the returns for Treasuries have been during this long secular bull market of falling bond yields, which has included 12 calendar years (back to 1978) where the annual return of the Treasury index was 10% or greater.

While markets may not neatly follow all the laws of physics, the old adage of “what goes up, must come down” is certainly a scary thought. I’ll hedge that statement slightly by saying “what goes up, may come down,” which I believe is increasingly becoming conventional wisdom among investors that long‐dated Treasuries really only represent portfolio insurance at this point, given their ability historically to zig when other parts of an investor’s portfolio (namely equities) zags.

Insurance is only good if your claim is approved!

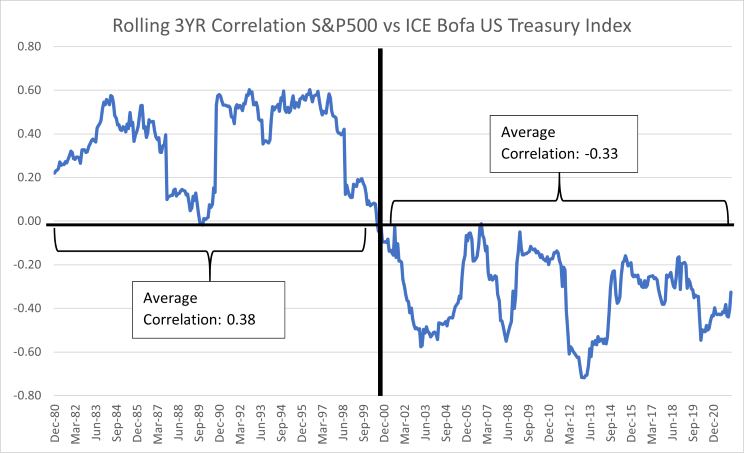

If the purpose of Treasuries is largely to provide portfolio insurance going forward rather than compelling absolute returns (nominal or real), can we be confident that they will continue to deliver a negatively correlated return profile to equities? Put another way, will our insurance claim be approved if equity markets sell off and we need to rely on Treasuries serving as a ballast in that environment?

Unfortunately, if we look at the long historical record, there are reasons to be skeptical about whether that will be the case. Exhibit 2 shows the rolling 3‐yr correlation between Treasuries and the S&P 500 over more than four decades to 1978. As you can see, for roughly the last 20 years dating back to 2000, Treasuries have averaged a negative ‐0.33 correlation to equities, which is exactly what investors would want from a portfolio insurance perspective.

However, if you look at the 20+ years prior to 2000, the correlation between Treasuries and equities averaged a positive 0.38, which provided some diversification benefits to investor portfolios but not the “zig when the other zags” outcomes that investors have come to expect.

Exhibit 2

Source: Morningstar Direct. As of February 2022.

How Can Investors Solve for the Treasuries Problem?

One of the challenges of managing around a potentially undesirable outlook for Treasuries is that they make up such a large percentage of commonly used fixed income benchmarks, such as the Bloomberg Aggregate Bond index, as well as within funds in the Morningstar Intermediate Core Bond Category.

For example, Treasuries currently make up approximately 40% of the weight of the Bloomberg Aggregate Bond Index. In addition, mutual funds within the Morningstar Intermediate Core Bond Category that have a current duration within +/‐ 0.5 years of the benchmark (6.28 to 7.28 duration as of 12/31/2021) had a median exposure to Government securities of 41% at the end of 2021.

Looking at the duration of funds in this space is important because one of the ways that managers within the core bond category have expressed a negative view on Treasuries (i.e., held them at a significant underweight to the benchmark) is by significantly reducing the duration of their overall portfolio, either by owning fewer Treasuries overall or by owning shorter maturity Treasuries like T‐bills.

This, in our view, exposes these funds to potentially finding themselves on the wrong side of future interest rate moves while also likely sacrificing precious yield in a still low yield environment.

Duration Neutrality does not have to Equal Sector Neutrality

Is it possible to be duration neutral within a core bond offering while also being significantly underweight to Treasuries? We would say emphatically yes! In fact, the Harbor Core Bond Fund sub advised by Income Research + Management (IR+M), adheres to a duration neutral posture (+/‐ 10% to the benchmark) and also currently (as of 12/31/2021) has a weight to Government / Agency securities like Treasuries of only 17.04%. Comparing this weight to the 41% median weight in the Morningstar intermediate core bond category of other duration‐neutral funds yields significant differences in how much is weighted to Government/Agency /Treasury securities, (i.e. "portfolio insurance") is being utilized among the intermediate core bond category.

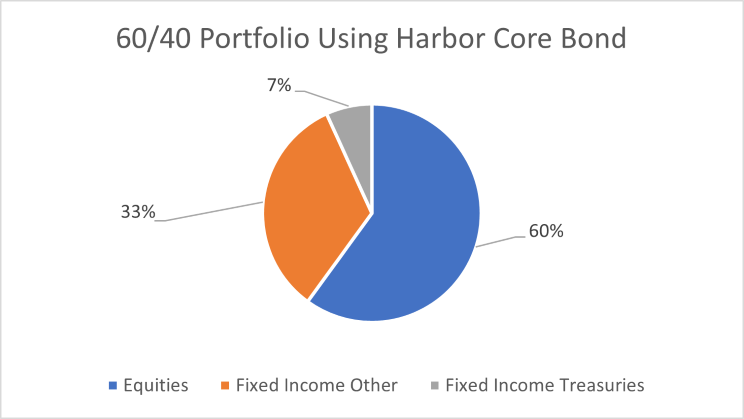

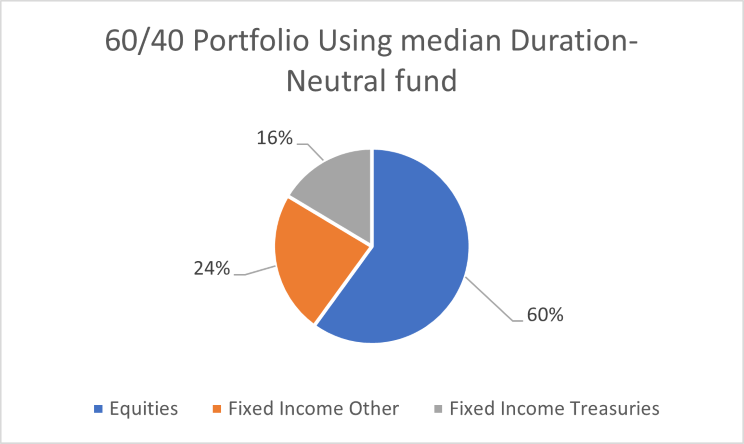

For example, if we apply this to a traditional 60% equity / 40% fixed income framework and hypothetically assume that either the median duration‐neutral manager or the Harbor Core Bond Fund is used for the entire 40% fixed income allocation, this yields meaningfully different portfolios in terms of Treasury exposure, as seen in exhibit 3. The portfolio using the median duration‐neutral fund would have approximately 16% of the total portfolio in Treasuries vs 7% for the portfolio using the Harbor Core Bond Fund.

Exhibit 3

Source: Harbor Capital Advisors. As of February 2022. Hypothetical for illustrative purposes only.

While the “right” amount of Treasuries exposure for a client portfolio is certainly subjective and specific to each investor’s unique circumstances, we believe that utilizing the Harbor Core Bond Fund within client portfolios may allow for broad diversification and lower exposure to relatively unattractive Treasuries without making a sizable interest rate bet from a portfolio duration standpoint.

Additionally, IR+M’s focus on quality within other sectors like corporate credit and securitized has not resulted in the fund having a meaningfully higher risk profile than the broad benchmark despite its consistent underweight to Treasuries.

For more information, please access our website at www.harborcapital.com or contact us at 1‐866‐313‐5549.

Legal Notices & Disclosures

For Institutional Use Only. Not for Distribution to the Public.

The views expressed herein may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Performance data shown represents past performance and is no guarantee of future results.

The Bloomberg US Aggregate Bond Index is an unmanaged index of investment‐grade fixed‐rate debt issues with maturities of at least one year. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The S&P 500 Index is an unmanaged index generally representative of the U.S. market for large capitalization equities. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

The Morningstar Intermediate‐Term Bond Universe represents all funds categorized as such by Morningstar. The Morningstar Intermediate‐Term Bond Universe (MF+ETF) represents all funds and ETFs categorized as such by Morningstar.

There is no guarantee that the investment objective of the Fund will be achieved. Fixed income investments are affected by interest rate changes and the creditworthiness of the issues held by the Fund. As interest rates rise, the values of fixed income securities held by the Fund are likely to decrease and reduce the value of the Fund's portfolio. The use of derivative instruments may add additional risk.

There may be a greater risk that the Fund could lose money due to prepayment and extension risks because the Fund invests heavily at times in mortgage‐related and/or asset backed securities. The Fund may engage in active and frequent trading to achieve its principal investment strategies. Investing in international and emerging markets poses special risks, including potentially greater price volatility due to social, political and economic factors, as well as currency exchange rate fluctuations. These risks are more severe for securities of issuers in emerging market regions.

Income Research + Management (IR+M) is an independent subadviser to the Harbor Core Bond Fund. Distributed by Harbor Funds Distributors, Inc.