Corporate Culture & The Human Capital Factor

March 01, 2023

Why We Believe It's an Underappreciated Value Driver

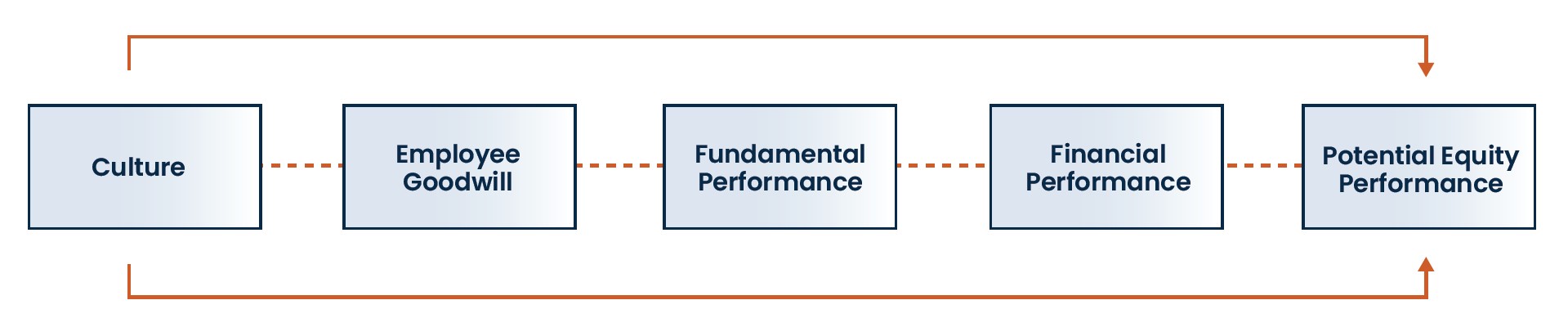

It is often said, “A company’s greatest asset is its people.” To us, this often repeated maxim makes intuitive sense – a company’s employees are responsible for serving customers, executing strategy, and delivering results. It stands to reason that a highly engaged and motivated staff gives a company an important competitive edge that should benefit financial results and ultimately equity performance.

Partnering with Irrational Capital

Nevertheless, company culture is not a line on the balance sheet. Accounting rules generally treat human capital as an expense or a future liability rather than an asset. When accounting rules fail to represent economic reality, equity mispricing can emerge, providing new avenues for alpha creation. Alpha is a measure of risk (beta1)- adjusted return.

Harbor has partnered with research firm, Irrational Capital, to provide investors a way to take advantage of this underappreciated value driver.

Irrational Capital, a firm founded by renowned behavioral scientist Daniel Ariely, has developed a method for systematically identifying companies with strong corporate culture. Based on Ariely’s extensive academic research, Irrational Capital has created a new quantitative investment factor—the Human Capital Factor (HCF) – by scientifically measuring what has historically been subjective and qualitative, i.e., how do large populations of employees feel and how motivated/engaged are they? The HCF score follows a formal process and is comprised of multiple characteristics fundamentally linked to Human Capital. Strong signals include levels of psychological safety, autonomy and pride.

Irrational Capital’s robust methodology for evaluating corporate culture spans both public and private data sets going back more than a decade. The entirety of the combined data sets in Irrational Capital’s research universe contains over 2,200 public companies, more than 10 million individual employee respondents, and over 500 million data points, including a range of self-reported demographic characteristics (such as gender, salary-band, seniority level, tenure and more).

We believe Irrational Capital’s research shows a strong link between each of the components of the Human Capital Factor and equity performance.

Explore HAPI

Harbor Capital has partnered with Irrational Capital to provide investors a way to capitalize on this groundbreaking Human Capital research.

Harbor Corporate Culture ETF (HAPI):

- Provides an objective and systematic way to invest in companies that have a history of strong corporate cultures.

- Offers exposure to large-cap companies with high Human Capital Factor scores, while constraining sectors in an effort to enhance overall diversification benefits.

- May make an effective diversifier because we believe it is uncorrelated to other factors and investment styles.

- Offers a compelling way to invest in the S* in ESG, which we believe tends to be underrepresented in sustainable investing.

- Grounded in powerful behavioral science research and backed by robust data sets.

*Invest in the S (social) in Environmental, social, and corporate governance (ESG) factors which may be incorporate into the investment process of the Fund which we believe tends to be underrepresented in sustainable investing. An ESG assessments represent only one of many considerations when making an investment decision. Investors should be aware ESG criteria, characteristics and/or assessments are often subjective in nature and may cause a portfolio to forgo other potentially attractive investment opportunities. Because of the subjective nature of ESG assessments, there can be no guarantee that ESG criteria, characteristics or factors used in any investment process will contribute to performance of the Fund. All investments, including ESG investing, are subject to risk and there is no guarantee that the investment objectives of the portfolio will be achieved, or the portfolio will be profitable. Please refer to each Funds prospectus, or summary prospectus if available, for further information on each Funds investment guidelines, and if applicable, ESG guidelines.

Important Information

All investments involve risk including the possible loss of principal. There is no guarantee that the objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. The Fund may not exactly track the performance of the Index with perfect accuracy at all times. Tracking error may occur because of pricing differences, timing and costs incurred by the fund or during times of heightened market volatility.

The Fund relies on the Index provider's methodology in assessing whether a company may be considered a corporate culture leader. There is no guarantee that the construction methodology will accurately assess a company to include or exclude it from the index which could have an adverse effect on the Fund's returns. The Fund's assets may be concentrated in a particular sector or industries to the extent the Index is concentrated and is subject to the risk that economic, political, or other market conditions that have a negative effect on that sector or industry will negatively impact the value of the Fund. Companies in the information technology sector can be significantly affected by short product cycles, obsolescence of existing technology, impairment or loss of intellectual property rights, falling prices and profits, competition from new market entrants, government regulation and other factors.

Diversification does not assure a profit or protect against loss in a declining market.

The Harbor Corporate Culture ETF is not an ESG dedicated Fund.

Investing involves risk, principal loss is possible. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals. They may not be reflective of current opinions, are subject to change without prior notice, and should not be considered investment advice.

Irrational Capital LLC is a third-party index provider to the Harbor Corporate Culture ETF. The Fund is managed by Harbor Capital Advisors, Inc.

CIBC is a third-party index provider to the Harbor Corporate Culture ETF. The Fund is managed by Harbor Capital Advisors, Inc.

1Beta is a measure of systematic risk, or the sensitivity of a fund to movements in the benchmark.

2766254