April CPI: Waiting On The Outlook To Change

May 11, 2023

Executive Summary:

- April Consumer Price Index (CPI) confirmed that inflation is continuing its gradual descent but provided few clues as to its ultimate landing spot.

- The lack of surprise in the data reinforces our view that the Federal Open Market Committee (FOMC) will keep rates on hold at their June meeting.

- However, with year-over-year inflation well above target at 4.9 percent, the interest rate cuts implied by the market will require a material growth slowdown or rapid disinflation.

- We continue to think that the former is a more likely outcome leaving us defensively positioned in our portfolios as we believe fixed income offers a more attractive risk/reward profile.

Something For The Optimists and The Pessimists

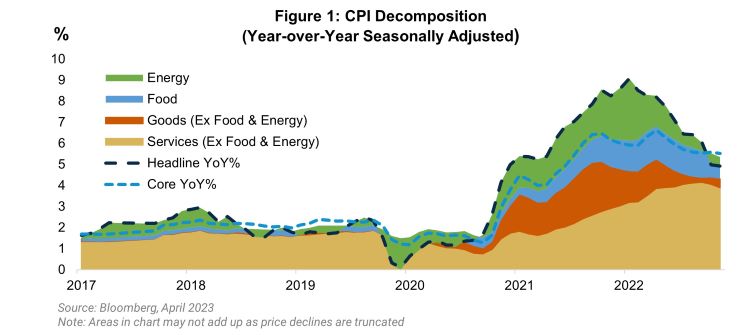

The April CPI increased 0.4 percent month-over-month for both the headline and core indices. Energy and used car prices account for most of the reacceleration in headline inflation from 0.1 percent in March to April, two idiosyncratic sectors that the Federal Reserve (Fed) will look through in gauging inflation’s underlying trend. Within the subsectors of the report, we learned little about the key question facing the Fed: are we on course to return to 2 percent inflation by 2024? Shelter is declining in an uneven manner, but forward-looking indicators leave us confident that the data will dip below the pre-COVID trend of 3-4 percent over the next year. Core goods prices, a sector including cars and furniture among others, have bounced in recent months and we expect it to remain volatile amid the crosscurrents of supply chain improvements, inventory uncertainty, and strong demand.

Core services, excluding shelter, is where the Fed remains focused given its link to the domestic labor market. This subcomponent remains volatile as well given the inclusion of airfares and medical insurance, an area exerting consistent downward pressure until it rolls into the new insurance year in the fall. However, the 0.1 percent month-over-month print is encouraging. The data increases the odds of a Fed pause at their June meeting without increasing the odds of cuts later in the year. Wage data has softened since the start of the year but continues to run above levels consistent with 2 percent inflation in the medium-term. The lesson from both the recent and historical episodes of elevated inflation is that progress is not linear and that the best course is to keep at it until it’s over.

Moving From Inflation To The Labor Market, Eventually

Leaving aside the question of where underlying inflation is heading, last week’s FOMC press conference provided some insight around the level of inflation below which the FOMC will begin to consider the trade-off between further disinflation and the labor market. Powell, in response to a question, noted that 3 percent inflation is a reasonable level at which the Committee will balance the two sides of the mandate. Granting that Powell’s response was improvised, we agree that 3 percent is a reasonable ceiling for where the Fed will carefully consider the marginal cost of higher unemployment against further disinflation.

The Fed continues to believe two things about the inflation process. First, inflation expectations anchor the long-run inflation trend and there are few signs of de-anchored expectations. Second, slowing growth and a weaker labor market result in lower inflation, i.e., deviations in inflation from trend are cyclical. So, in a best-case scenario where inflation falls below 3 percent without a meaningful deterioration in the labor market, the Fed will be comfortable with inflation running closer to 3 rather than 2 percent so long as expectations remain anchored. The bet is that future business cycles will address the deviation from 2 percent.

The Asymmetric Downside of Equity Risk

The April CPI print does not change our outlook. Despite continued strength, we think it is only a matter of time before the labor market deteriorates materially. The cumulative effects of 500 basis points1 of Fed tightening, stress in the banking system, and negative year-over-year earnings growth for the S&P 500 could force companies to shed workers, lifting the unemployment rate from a historic low. A rising unemployment rate means an elevated risk of recession. And even if we are too pessimistic, we believe the best-case scenario of a mix of high interest rates and below trend growth are not conducive to high equity returns. As a result, we prefer fixed income to equity risk in balanced portfolios as the yield compensation for volatility far surpasses the equity cash returns equivalent. Within both asset classes, we retain a preference for quality, free cash flow generating businesses, while avoiding lower-rated, and more levered companies.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

1 Basis Point - A basis point is one hundredth of 1 percentage point.

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

2899357