April CPI: Past Peak Inflation Offers Little Relief

May 22, 2022

Executive Summary

- The April Consumer Price Index (CPI) printed at 8.3 percent year-over-year,

a modest deceleration from last month’s 8.5 percent, but still well-above

market expectations. - Services inflation continues to accelerate amid growing signs of a parallel

acceleration in wages. - The data leaves the Federal Open Market Committee (Fed, FOMC) positioned

for a series of 50 basis point rate hikes at their upcoming meetings. - The window of opportunity to achieve a soft landing continues to narrow for

the Fed. - Position for a further tightening in financial conditions through high quality

and defensive exposures.

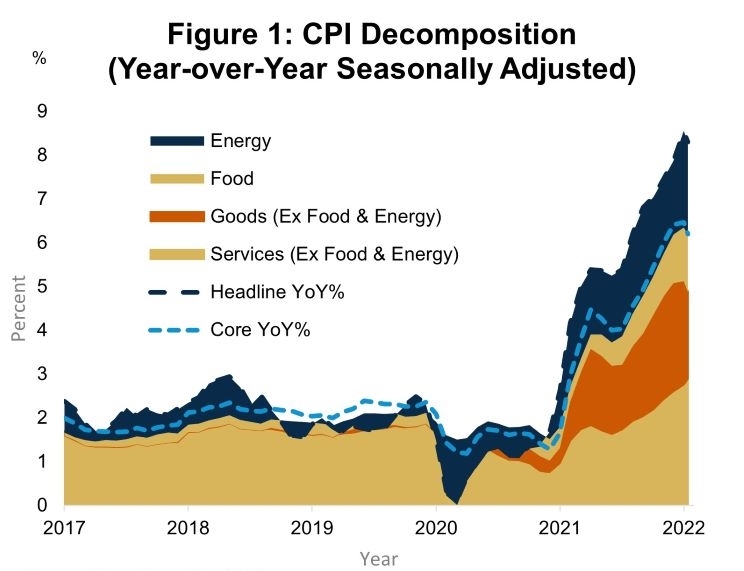

Is the Switch from Goods to Services Consumption Helping?

The transition of elevated spending on goods, e.g., cars, that characterized most of the pandemic towards services is evident in both personal consumption expenditure and CPI data. However, the rapid acceleration of services inflation alongside lower, but still positive goods inflation is concerning. Each subcategory of the services sector increased, while overall services inflation accelerated for the fourth consecutive month rising 0.7 percent month-over-month. The Fed is far more focused on services inflation as this sector is more responsive to domestic labor market conditions as wages comprise a larger share of the input costs for this sector. As a result, the persistence in services inflation could reflect early signs of a wage-price spiral, a situation in which higher inflation becomes self-reinforcing.

Source: Bloomberg, May 2022

Note: Areas in chart may not add up as declines in prices are truncated.

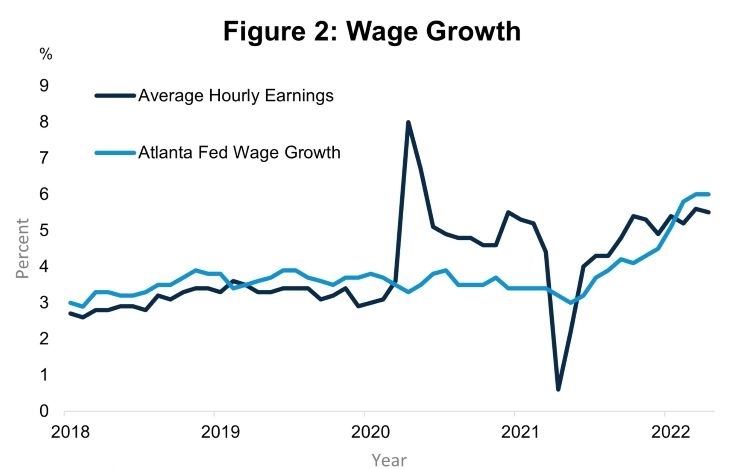

Wage data is accelerating as well, although, so far, the gains are not outstripping realized inflation. The Atlanta Fed wage tracker increased 6 percent year-over-year as of March with a similar magnitude increase observed in April’s employment situation report. This means that real wages are falling, which is providing a tailwind to hiring. However, the concern arises when wage demands remain elevated as realized inflation falls, which would induce subsequent price increases from businesses generating a wage-price spiral. It’s too early to conclude whether we are in a wage-price spiral, but the longer high inflation persists the more likely it becomes and, with it, the increased cost of slowing the economy for the FOMC.

Source: Bloomberg, May 2022

Second-round Effects of Commodity Price Inflation

The war in Ukraine has resulted in higher and more volatile commodity prices, which have plateaued over the past month. However, we may be seeing initial signs of the second-round effects of the past increases in commodities, particularly in food and energy, in consumer prices. Airline fares increased 18.6 percent month-over-month, the fastest pace on record, as elevated jet fuel prices compounded the effect of pent-up travel demand. Elevated energy prices will also filter into home rents through their effect on utility costs on a lagged basis.

Food prices are affected by the war through several channels, which are likely to persist beyond 2022. Higher gas prices make the production of fertilizer more costly at a time when fertilizer was already in short supply due to the pandemic and with the largest exporter, Russia, unlikely to reach past production volumes. High fertilizer prices are now forcing farmers to switch production away from more fertilizer-intensive crops like corn towards soybeans. The decline in corn production in the U.S. and other countries will exacerbate the shortage stemming from dwindling supply in Ukraine due to the war. We expect the price signals from the war to have other unintended consequences for food markets, as well as exacerbating inflation globally, particularly in lower-income countries where food makes up a much larger share of consumption.

The Mountain Became a Little Steeper for the Fed to Climb

The Fed will stay the course after the April CPI data. 50 basis point hikes in June and July, and a narrower window now to avoid a fourth 50 basis point hike at the September meeting. We don’t think talk of a 75 basis point hike will return to the fore after Powell’s press conference at the May FOMC, but the probability of one increases ever so slightly. One reason to doubt that the Fed will need to move more aggressively in the near term is financial conditions tightened significantly since the May FOMC meeting. As we expected, the incremental tightening stemmed from lower equity prices and wider credit spreads rather than further increases in risk-free rates. We believe this will continue and favor defensive exposures in equity and fixed income markets.

For more information, please access our website or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

This material may reference counties which may be generally the subject of selective sanctions programs administered. Readers of this commentary are solely responsible for ensuring that their investment activities in relation to any sanctioned country is carried out in compliance with applicable Laws, rules or policies.

The Bloomberg Commodity Index is an unmanaged broadly diversified commodity price index distributed by Bloomberg Index Services Limited. This unmanaged index does not reflect fees and expenses and is not available for direct investment.

Basis points (BPS) refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

Performance data shown represents past performance and is no guarantee of future results.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Harbor Capital Advisors, Inc.