Harbor Corporate Culture Leaders ETF (HAPY) Strategy Profile

Access a data-driven strategy that seeks to capture the link between strong corporate culture and equity value.

Harbor Corporate Culture Leaders ETF (HAPY) Strategy Profile

Access a data-driven strategy that seeks to capture the link between strong corporate culture and equity value.

Harbor Corporate Culture Leaders ETF

Ticker: HAPY | February 2022

Download this Strategy Profile as a PDF | Visit HAPY Product Page | Contact Your Harbor Representative

Fund Highlights

Invests in Human Capital. The Human Capital Factor, upon which HAPY is built, strives to deeply understand company culture and intrinsic employee motivation as a potential driver of stock performance.

Outcome Oriented. Socially Conscious. The index underlying HAPY takes a socially conscious approach that aims to access the potential alpha* opportunity of strong corporate culture.

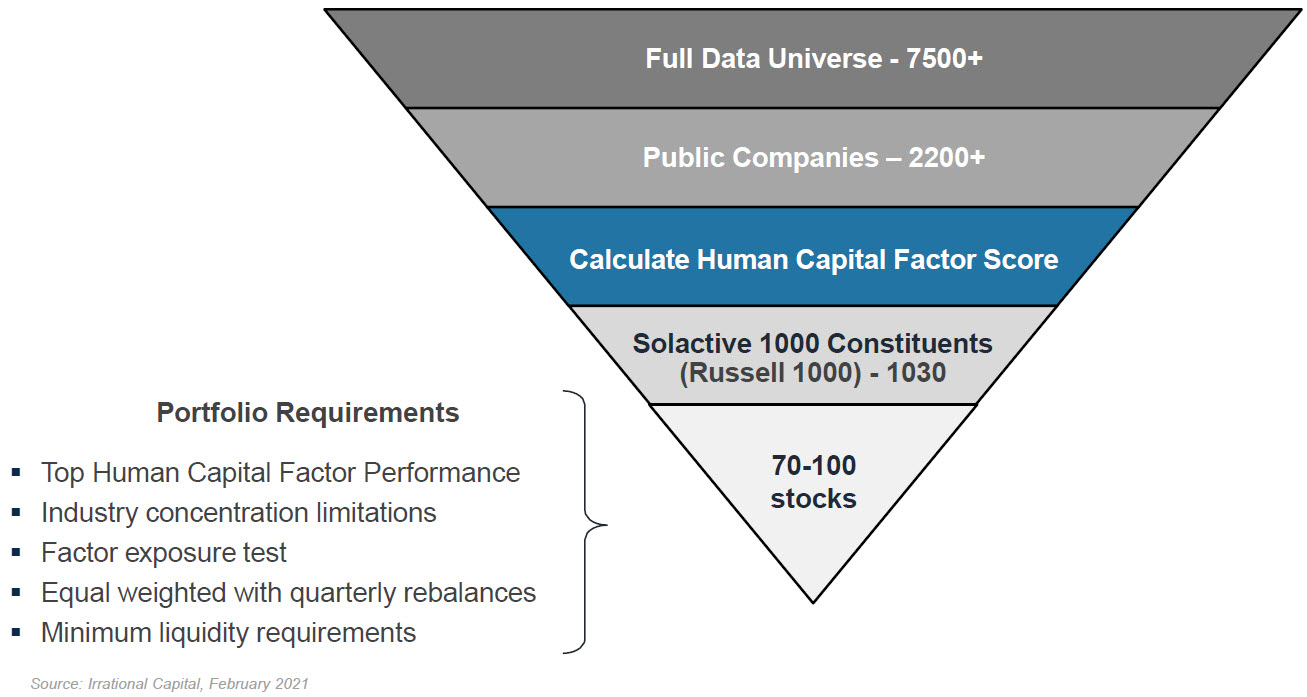

Backed by Data. The Human Capital Factor is grounded in a robust, nonreplicable dataset of both public and proprietary sources, covering 2,200+ public firms, 10M+ employee responses totaling 500M+ data points1.

Overview

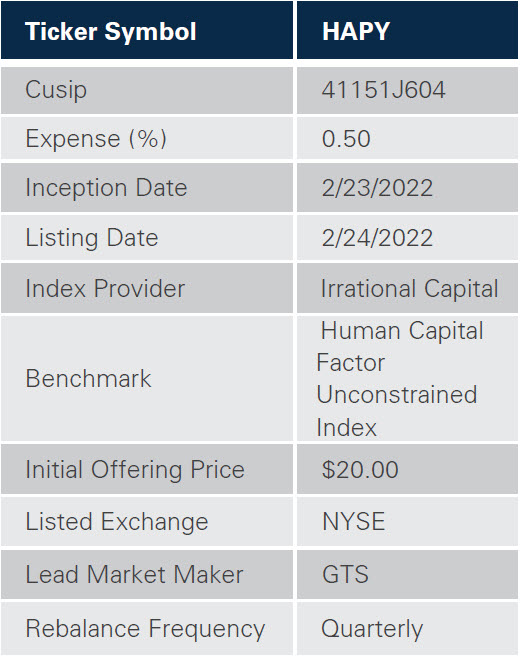

The Harbor Corporate Culture Leaders ETF (HAPY) seeks to provide investment results that correspond, before fees and expenses, to the performance of the Human Capital Factor Unconstrained Index (the “Index”). The Fund employs an indexing investment approach designed to track the performance of the Index. The Fund invests at least 80% of its total assets in securities that are included in the Index.

The Index is designed to deliver exposure to equity securities of large cap U.S. companies that demonstrate high employee engagement and motivation, based on human capital scores produced by Irrational Capital LLC. Irrational Capital is an investment research and development firm that applies workplace behavioral science, financial acumen, and data science to capture the powerful connection between human capital and financial outcomes. Irrational Capital’s Human Capital Factor goes beyond simple check-the-box social investing by deeply understanding company culture and intrinsic employee motivation, then transforming these insights into investment strategies.

The Index Provider calculates Human Capital Factor scores based on a proprietary scoring methodology developed by Irrational Capital leveraging its research in behavioral science, data science and human capital. The scoring methodology seeks to quantitatively measure the contribution of a company’s corporate culture to its financial performance.

ETF Structure

- Cost Effective: HAPY is a cost-efficient way to gain access to a diversified, socially conscious, and cutting-edge strategy focused on human capital.

- Liquid: The ETF vehicle can be traded throughout the day, which provides intra-day liquidity for shareholders.

- Tax-efficient: Due to the in-kind exchange of shares, the ETF vehicle may allow for greater tax efficiency and reduced costs.

- Transparent: The availability of daily holdings may allow investors to make more informed investment decisions.

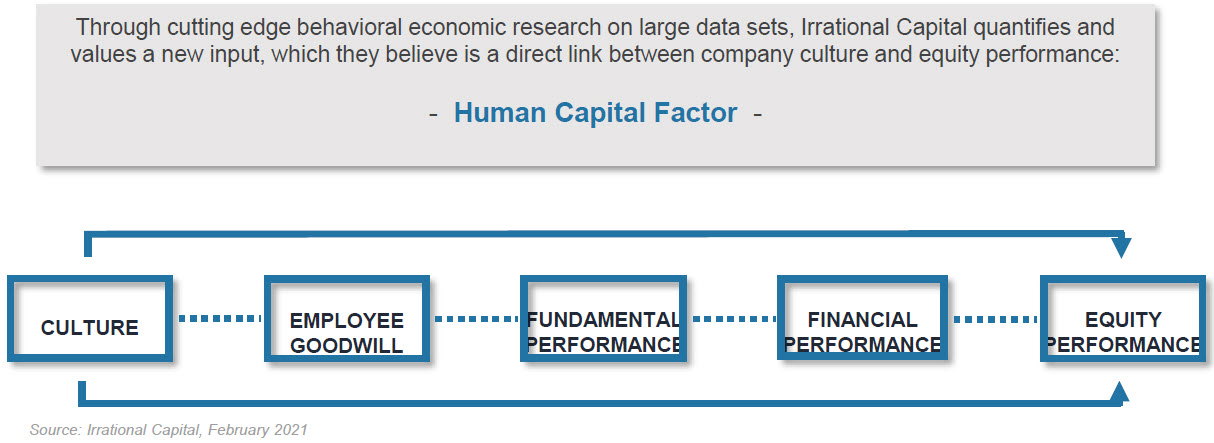

Harbor’s Partnership with Irrational Capital

Harbor has engaged Irrational Capital as the index provider for the Harbor Corporate Culture Leaders ETF. Irrational Capital is a boutique investment research firm. The firm is wholly dedicated to studying the financial impact of corporate culture. Through transparent, cutting edge behavioral economic research, Irrational Capital has uncovered what they believe to be a new, potential direct link between company culture and equity performance: The Human Capital Factor.

Investing in Human Capital

Business leaders often assert that a company’s most important asset is its people. However, human capital is not treated as an asset on a balance sheet. The Human Capital Factor offers an objective and systematic way to assess and invest in strong corporate culture.

Irrational Capital’s Data Edge

Strategies focused on social characteristics tend to evaluate companies based on easily measurable inputs. However, we believe that evaluating the social components of corporate culture requires a deeper lens into intangible factors that are not captured in broadly available disclosure data.

Irrational Capital’s data advantage lies in moving away from disclosure data to analyzing what companies are really doing – intention and behavior – through employee surveys that give employees a voice that Irrational Capital believes uncovers more meaningful results. Through proprietary surveys and public data, the Human Capital Factor measures intrinsic and extrinsic motivation in order to establish the relationship between employee well being and business fundamentals which, in turn, can impact equity performance.

HAPY Portfolio Construction

For more information, please visit www.harborcapital.com/etfs or call (866) 313‐5549.

1These figures represent Irrational Capital’s full dataset. The Harbor Corporate Culture Leaders ETF is constructed utilizing a subset of this data.

*Alpha is the excess return of an investment relative to the return of a benchmark index.

Legal Notices & Disclosures

All investments involve risk including the possible loss of principal.

There is no guarantee that the investment objective of the Fund will be achieved. Stock markets are volatile and equity values can decline significantly in response to adverse issuer, political, regulatory, market and economic conditions. The Fund may not exactly track the performance of the Index with perfect accuracy at all times. Tracking error may occur because of pricing differences, timing and costs incurred by the fund or during times of heightened market volatility.

The Fund relies on the Index provider's methodology in assessing whether a company may be considered a corporate culture leader. There is no guarantee that the construction methodology will accurately assess a company to include or exclude it from the index which could have an adverse effect on the Fund's returns. The Fund's assets may be concentrated in a particular sector or industries to the extent the Index is concentrated and is subject to the risk that economic, political, or other market conditions that have a negative effect on that sector or industry will negatively impact the value of the Fund.

Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. The ETF is new and has limited operating history to judge.

Investors should carefully consider the investment objectives, risks, charges and expenses of a Harbor fund before investing. To obtain a summary prospectus or prospectus for this and other information, visit harborfunds.com or call 800-422-1050. Read it carefully before investing.

Foreside Fund Services, LLC is the Distributor of the Harbor Corporate Culture Leaders ETF.

Irrational Capital is a third-party index provider to the Harbor Corporate Culture leaders ETF.

3166006

Download this Strategy Profile as a PDF | Visit HAPY Product Page | Contact Your Harbor Representative